Who We Are

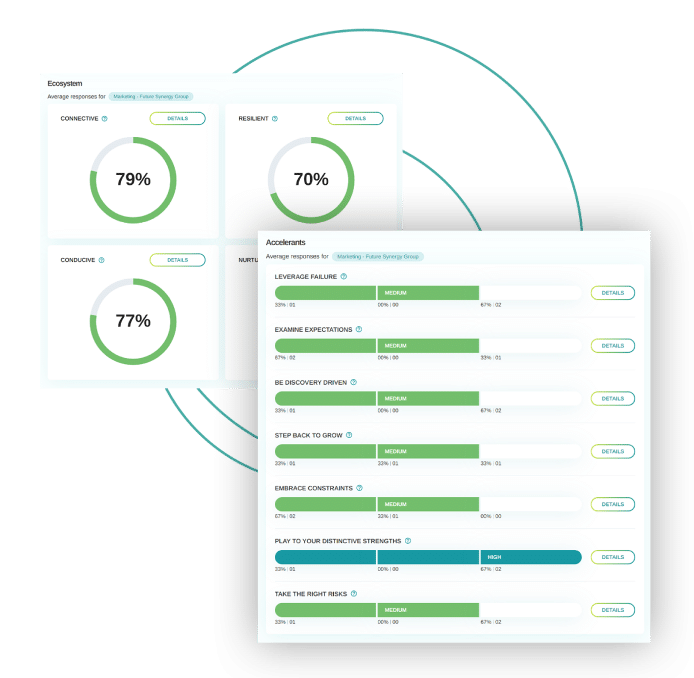

Smart Growth Activators

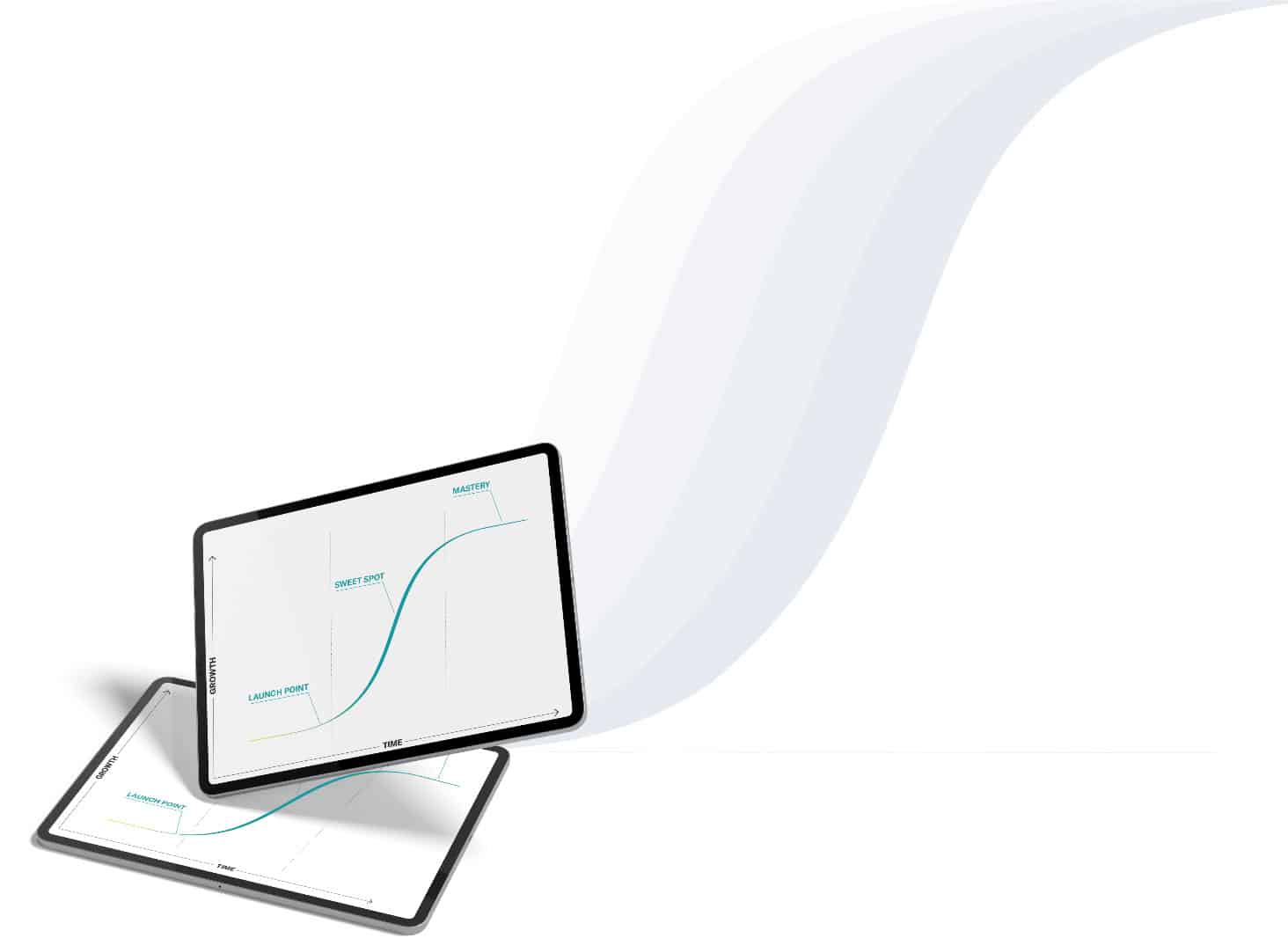

Disruption Advisors is a tech-enabled leadership development company leveraging its proprietary S Curve™ framework and tools to help you grow.

Disrupt Yourself

Companies don’t disrupt, people do.

Play Video about Smart Growth Certification

Disrupt Yourself Podcast

With Whitney Johnson

Listen in as Whitney talks with notable leaders about their growth through disruption.

Books

Smart Growth: How to Grow Your People to Grow Your Company

Wall Street Journal, USA Today, Amazon bestseller, named one of 10 Best New Management Books for 2022 by Thinkers50.

Sign up to get

Your Monthly Dose of Disruption